by system

Share

by system

Share

Evaluate security policies

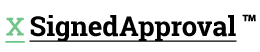

The combination of different types of fraud over time can result in a significant financial impact. To prevent intentional friendly fraud and policy abuse, follow these three steps:

- Assess refund and return policies

The first step is to examine your refund and return policies. Are they too lenient or ambiguous? Put yourself in the shoes of a dishonest actor. If you find that the language is vague or confusing, modify your policies to close any loopholes.

Additionally, ensure that your customers are well-informed about your policies. Do you include them in purchase confirmations or on the customer support page of your website? If bad actors attempt to dispute a purchase, they may claim that your policies are unclear or difficult to find.

- Train customer support staff on social engineering

Next, train your customer support teams to recognize social engineering tactics that can facilitate policy abuse. Dishonest actors who offer refunds as a service may pretend to be customers and try to appeal to service agents emotionally or become angry when requesting refunds.

Remember that fraud analysts are not the only ones who need to be alert to intentional friendly fraud. Walkthrough different customer scenarios and train your support agents to identify cases of policy abuse fraud.

- Invest in a friendly fraud solution

The most effective and rapid approach to prevent intentional friendly fraud and policy abuse is to invest in a friendly fraud solution. While a digital fraud prevention solution can prevent criminal fraud before authorization, a friendly fraud solution can help deflect disputes and stop chargebacks after authorization.

A friendly fraud solution can offer you access to post-authorization tools from major card brands within a single dashboard. Here’s an example: if a customer or bad actor starts a dispute with their bank and requests a refund, you can rapidly (in some cases, automatically) share transaction details with the bank, preventing the chargeback.

The solution can also be used to identify areas where your business policies need improvement. And it’s not just useful in halting intentional friendly fraud. For instance, if you approve a refund for a good customer and the funds aren’t promptly returned, the customer may go to the bank and assert that you haven’t issued the refund. In such a scenario, you can instantly inform the bank of the refund in progress when you receive the dispute alert, avoiding the double-refund and chargeback.

Overall, selecting the appropriate friendly fraud solution can assist you in retaining sales, resolving disputes, and enhancing your business policies.

STAY IN THE LOOP

Subscribe to our free newsletter.

Vivamus magna justo, lacinia eget consectetur sed, convallis at tellus.

x SignedApproval™ Instant chargeback fraud reporting to bank security authorities

x SignedApproval™ Instant chargeback fraud reporting to bank security authorities

x SignedApproval™ Instant chargeback fraud reporting to bank security authorities