by system

Share

by system

Share

How Does Data Analysis Help Prevent Chargebacks?

With data, you make educated decisions. But without data, you make hunches and guesses. You have no way of knowing what is actually happening, what will be an effective solution, or whether or not you’ve fixed the problem.

Many times, when a chargeback is received, a merchant focuses solely on fighting the chargeback and recovering lost revenue. While this step is important, it isn’t the only thing to worry about.

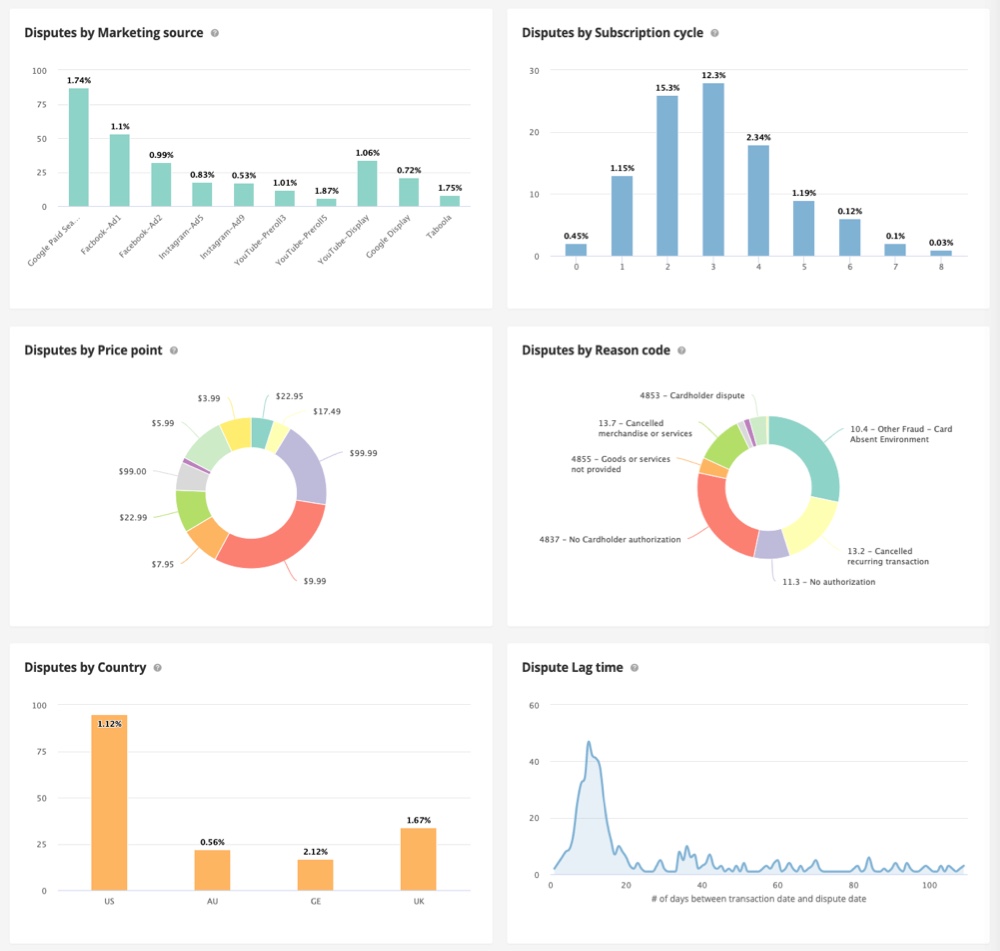

Each chargeback you receive contains a wealth of information. If you analyze that data, you can gain valuable insights — including why the transaction was disputed in the first place. This allows you to solve issues at their source.

Create reports and charts that help you understand the data.

STAY IN THE LOOP

Subscribe to our free newsletter.

x SignedApproval™ Instant chargeback fraud reporting to bank security authorities